milwaukee wi sales tax 2020

The minimum combined 2022 sales tax rate for Milwaukee Wisconsin is. An alternative sales tax rate of 55 applies in the tax region Oak Creek which appertains to zip code 53172.

Wisconsin Tax Exempt Form 2020 Pdf Fill Online Printable Fillable Blank Pdffiller

Milwaukee County WI Sales Tax Rate.

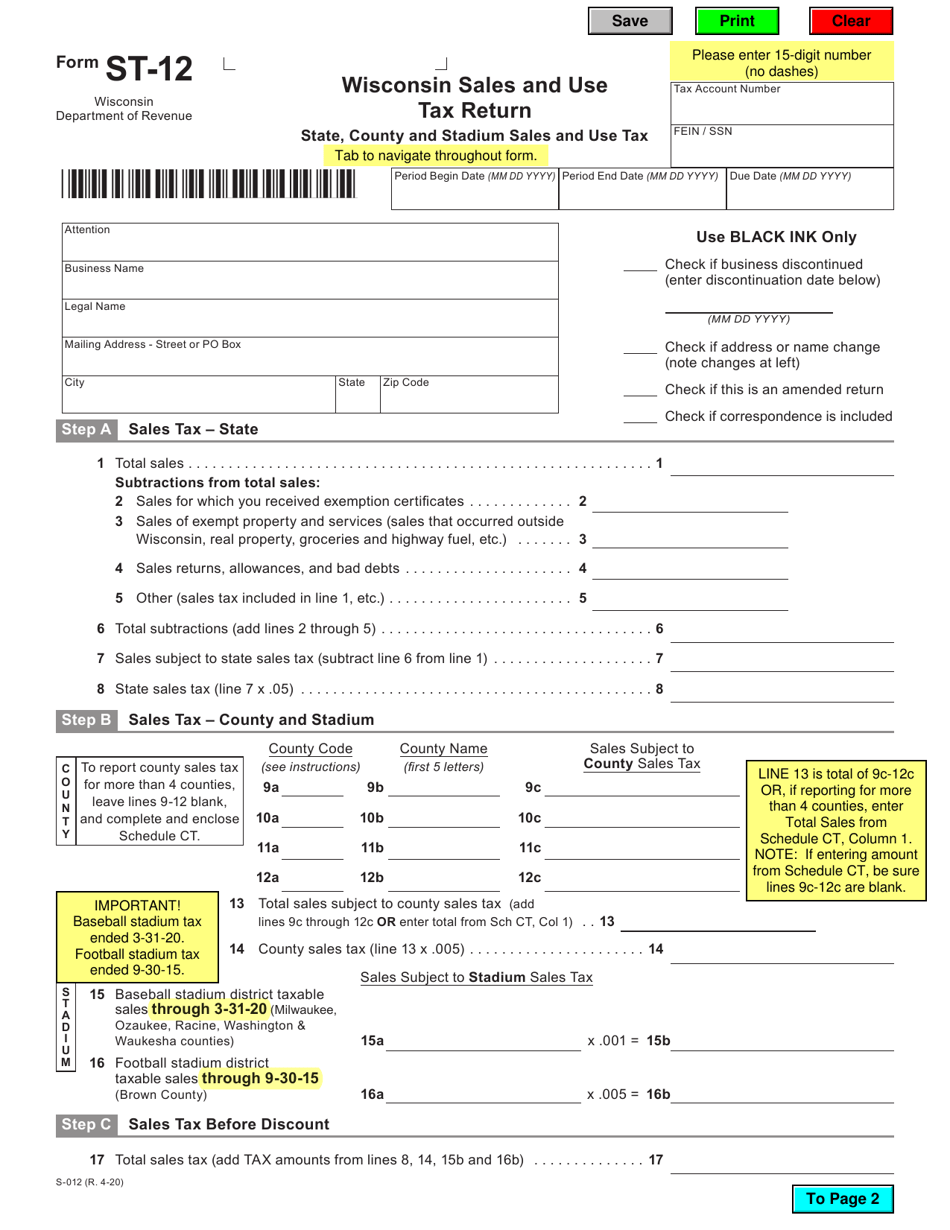

. The 55 sales tax rate in Milwaukee consists of 5 Wisconsin state sales tax and 05 Milwaukee County sales tax. For taxable sales made prior to April 1 2020. Baseball stadium tax ended March 31 2020 Use tax.

5 state sales tax 05 county sales tax and. MILWAUKEE -- Mayor Tom Barrett and other lawmakers want to add 1 to the Milwaukee County sales tax which would need approval from the state Legislature for a referendum. Other taxes and fees.

Wisconsin has 816 special sales tax jurisdictions with local sales taxes in. The current total local sales tax rate in South Milwaukee WI is 5500. Remember that zip code boundaries dont always match up with political boundaries like South Milwaukee or.

You can print a 55 sales tax table here. Milwaukee Leaders Plead for 1 Sales Tax - Steven Walters - Mar 16th 2020 County Sales Tax Legislation Gets Hearing - Graham Kilmer - Mar 5th 2020. The program is open to individuals and families who live in Wisconsin with overdue housing-related bills both with and without a mortgage who meet income and other eligibility.

Wisconsin has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 06. These include the 05 sales tax that will soon be imposed on 68 of 72 Wisconsin counties the soon expiring 01 stadium sales tax in Milwaukee Ozaukee Racine Washington and Waukesha counties. State sales and use tax 5 County sales and use tax 05 Baseball stadium district sales and use tax 01 - This tax ended March 31 2020.

The current law caps. The Milwaukee County Sheriff has real estate auctions every Monday morning on properties that are lender foreclosures due to non-payment of the mortgage. Select the Wisconsin city from the list of popular cities below to see its current sales tax rate.

There are approximately 17557 people living in the South Milwaukee area. Did South Dakota v. This is the total of state county and city sales tax rates.

There is no applicable city tax or special tax. For tax rates in other cities see Wisconsin sales taxes by city and county. With local taxes the total sales tax rate is between 5000 and 5500.

There are a total of 100 local tax jurisdictions across the state collecting an average local tax of 0481. 4-20 15 Baseball stadium district taxable sales through 3-31-20 Milwaukee Ozaukee Racine Washington Waukesha counties 15a x 001 15b 16 Football stadium district taxable sales through 9-30-15 Brown County 16a x 005 16b. Counties and cities can charge an additional local sales tax of up to 06 for a maximum possible combined sales tax of 56.

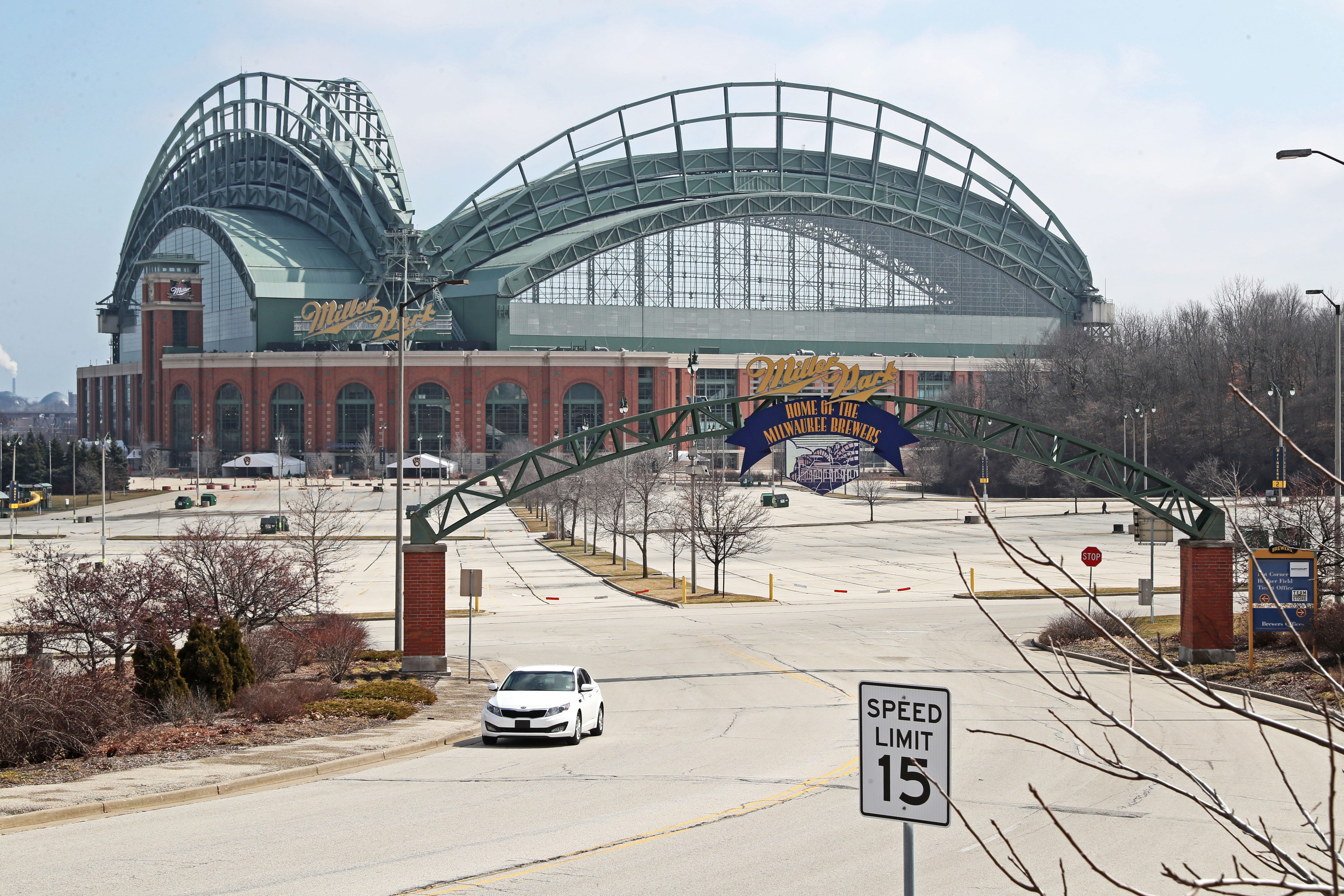

If you are interested in a property included in one of the Sheriffs auctions. Basic room tax 25 - Increases to 3 effective January 1 2021. The good news were told is that the Miller Park tax is projected to sunset in late 2019 or early 2020 as Fox 6 recently reported and the.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. The current total local sales tax rate in Milwaukee County WI is 5500. 01 lower than the maximum sales tax in WI.

The December 2020 total local sales tax rate was 5600. Wisconsin has recent rate changes Wed Apr 01 2020. The County sales tax rate is.

Retailers who make sales subject to the baseball stadium tax in Milwaukee Ozaukee and Washington Counties remit 56 sales tax on such retail sales. Fast Easy Tax Solutions. The State of Politics.

The South Milwaukee Wisconsin sales tax rate of 55 applies in the zip code 53172. The Milwaukee sales tax rate is. The Wisconsin sales tax rate is currently.

Wisconsin Help for Homeowners Wisconsin Help for Homeowners WHH is a new statewide program that can help with overdue bills like mortgage payments property taxes utilities and more. Average Sales Tax With Local. As of May 15 Milwaukee County has so far collected 33 million in sales tax revenue for 2020 a slight decrease compared with 333.

Additional information is available by calling 414-278-4907 between 8 am. 31 rows Wisconsin WI Sales Tax Rates by City. Groceries and prescription drugs are exempt from the Wisconsin sales tax.

Ad Find Out Sales Tax Rates For Free. The state sales tax rate in Wisconsin is 5000. The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Milwaukee County local sales taxesThe local sales tax consists of a 050 county sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc.

01 baseball stadium sales tax.

Form St 12 Download Fillable Pdf Or Fill Online Wisconsin Sales And Use Tax Return Wisconsin Templateroller

Evers Budget Proposal Would Allow Milwaukee Sales Tax Urban Milwaukee

Wisconsin Sales Tax Small Business Guide Truic

Milwaukee Leaders Warn Of Dire Future Without Shared Revenue Sales Tax Increase Wisconsin Public Radio

Spending Wisconsin Budget Project

Report In The Last 40 Years Wisconsin S Income Tax Has Become Less Progressive Wisconsin Public Radio

Miller Park 4 3 Million Tax Surplus To Be Split Among 5 Counties

Wisconsin Sales Tax Rates By City County 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Wisconsin School Property Taxes Rise After Another Successful Year For Referendums Wisconsin Public Radio